- by PURVIS

- August 30, 2019,

- 0 Comments

Newport’s Naval Undersea Warfare Center a hub for defense-based research and development

There’s no denying the boost Rhode Island’s economy gets from the Naval Undersea Warfare Center Division Newport. Like so many other parts of the nation’s military industrial complex, the system was designed that way. The Pentagon calls it “strategic contracting.”

The premise is simple: The more military contracts are spread around, the more cities and towns – and even entire regions – come to rely on them.

Four of the Pentagon’s top five contractors – Lockheed Martin Corp., Raytheon Co., Northrup Grumman Corp., and General Dynamics Corp. – have offices near NUWC in Middletown and Portsmouth on Aquidneck Island. The big firms are complemented by a variety of smaller companies clustered on the island and around the region that do business with NUWC, this year celebrating its 150th anniversary.

And business is trending up for the center and the many companies – near and far – that contract with it.

DEFENSE GROWTH

Nestled along Narragansett Bay in Middletown and Newport, the 180-acre, 76-building complex has seen modest staff increases and steady funding in recent years.

The number of workers at the sites, both Department of Defense civilian employees and those from private contractors, has climbed to between 6,100 and 6,200 – an increase of more than 200 positions since last fall.

The workforce mainly consists of highly paid professionals such as engineers and scientists, administrators and technicians. About 4,500 of them live in Rhode Island.

Total funding at NUWC is projected to reach $1.18 billion this fiscal year, up slightly from $1.12 billion in fiscal 2018. Funding for the 2016 and 2017 fiscal years was $1.07 billion and $1.17 billion, respectively.

About $340 million of last year’s funding went to companies in southern New England, including nearly $288 million in contracts to firms based in Rhode Island – an increase from the two previous years.

Meanwhile, the Department of Defense has given NUWC “other transactional authority,” a somewhat rare designation that allows it to speed up contracting, especially for companies focusing on innovative technologies.

In addition to potential benefits for the U.S. Navy, the OTA designation was intended to draw more companies, especially local ones, into NUWC’s contracting fold.

“Rhode Island companies in the defense sector are seeing an expansion,” said Molly Donohue-Magee, a former manager at NUWC.

She now serves as executive director of the Southeastern New England Defense Industry Alliance, a Middletown-based coalition of 130 defense contractors in the region that formed in 2002, including many that do business with NUWC.

The growth trend resulted in the creation of a second business coalition in 2017, the Undersea Technology Innovation Consortium. The group, consisting of 250 companies in 36 states, also is based in Middletown with Donohue-Magee serving as its figurehead.

“There’s been a strong emphasis on innovation in recent years,” Donohue-Magee said about NUWC.

SUB SPECIALTY

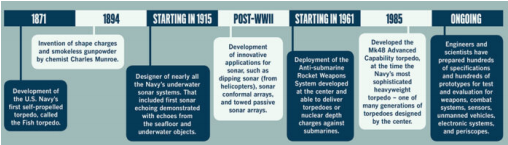

NUWC traces its beginnings back to 1869, when it was called the Naval Torpedo Station on Goat Island in Newport.

It was the Navy’s first research and development laboratory for undersea warfare systems. At the time, armored ships, mines, torpedoes, and other technological innovations – including the submarine – had been introduced as new concepts in naval warfare.

The station was supported by some contractors already in Rhode Island, while others have moved into the area through the years because of the contract opportunities presented by the center.

The original station – just a fraction of its size today – has evolved through name changes and reconfigured missions over the years: the Naval Torpedo Station (1869 to 1951), the Naval Underwater Ordnance Station (1951 to 1966), the Naval Underwater Weapons Research and Engineering Station (1966 to 1970), the Naval Underwater Systems Center (1970 to 1992), and finally NUWC Division Newport in 1992.

During World War II, employment at the station peaked at more than 13,000, including many women to support around-the-clock operations, from 1941 through 1944. The facility ramped up torpedo production, making more than 18,700 weapons during that period.

More recently, NUWC has evolved into a federal clearinghouse of sorts for Rhode Island’s high-tech economy.

The center isn’t funded as a line item in the defense budget. Instead, the spending is categorized as a Navy working capital fund and the center “bills” federal agencies – mainly those in the Navy – for the work it performs.

Contracts either have prices that are fixed at the time of the agreement or that are flexibly priced, allowing for reimbursement of incurred costs. The decision on which type of contract is most appropriate is based on the degree of “cost risk” associated with contractor performance of NUWC’s requirements.

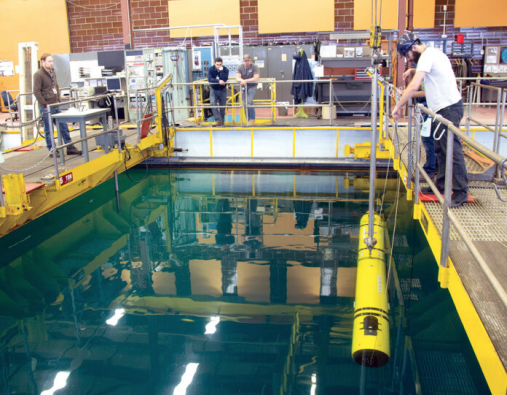

NUWC handles research and development, testing and evaluation, and engineering and other technical support services for the Navy’s submarines and other underwater systems.

Not only does the center procure contracts for the United States military, it also does so for the militaries of allied countries.

No heavy manufacturing takes place at NUWC. It’s used mainly for providing professional and technical services.

That includes designing and developing new systems and upgrading or fixing existing ones – from torpedoes and missiles and the systems that launch them, to radar and sonar systems, communications systems, equipment and devices using electromagnetic technology, and unmanned undersea, surface and aerial vehicles for the Navy.

Sometimes, it involves sending experts around the globe to troubleshoot problems with naval undersea vessels and equipment. Other times, it involves bringing equipment back to Newport for work. Exact replicas of systems and equipment also are kept there.

“We do everything that goes into a sub, except the hull and the nuclear propulsion system – the engine. Everything else is ours,” said NUWC Communications Specialist John Woodhouse, who compared the site to a college campus with high security.

“We cover everything – from the cradle to the grave,” Woodhouse said about services rendered through the life of vessels and equipment. “When we can’t do it here, we send our people wherever they are in the world,” he added, “because the last thing you want is to have a big vessel in dry dock for repairs.”

In July, NUWC marked its 150th anniversary. The ceremony was highlighted by the unveiling of a monument dedicated to the many men and women who have worked there through the two world wars, the Cold War, and other key military campaigns right up to today’s naval operations around the globe.

Critics of the nation’s increasing defense budget have questioned whether certain military projects are necessary. However, the Navy’s submarine program, linked to much of NUWC’s work, generally isn’t among them.

“There’s a need to invest in new [defense] technologies,” said Sen. Jack Reed, D-R.I., the ranking member of the Senate Armed Services Committee, which oversees the military. “We have to build these submarines because of the threat and the strategic environment.

“First, whatever it is [that’s built] must be critical to national security,” Reed added. “When it comes to submarines, everyone – with very few exceptions – concedes that they are priorities of the first order.”

RIPPLE EFFECTS

Money spent for NUWC contracts in calendar 2018 totaled $537.8 million, with contracts to companies in southern New England exceeding $340 million. That included $287.8 million awarded to Rhode Island-based businesses; $41.8 million to Massachusetts-based companies; and $10.7 million to Connecticut businesses.

Last year’s contract total for Rhode Island-based businesses was up from $281.9 million in 2017 and $262.4 million in 2016, according to figures supplied by the center.

However, yearly contracting totals can fluctuate. In 2008, for example, Rhode Islandbased companies received approximately $189 million through NUWC. But in 2009 the total jumped up to about $288 million for Rhode Island firms.

Erin Donovan-Boyle, executive director of the Newport County Chamber of Commerce, sees the economic ripple effects of NUWC in the local business community.

Not only are 20 to 25 of the Chamber’s members contractors with NUWC, she said, but many small businesses in the Aquidneck Island area benefit from the ancillary spending by NUWC employees and its affiliated businesses.

“There’s a huge economic impact from defense workers,” Donavan-Boyle said. “They spend dollars locally.”

“There are a number of [networking] events coming up” to help local businesses tap into various contracting opportunities at NUWC, she added.

Last year, NUWC’s contracting capabilities were enhanced by the other-transactionalauthority designation. It allows for faster and more flexible contracting, particularly for the delivery of technologies and related prototypes.

The designation involves a three-year agreement between NUWC and the Undersea Technology Innovation Consortium. Companies must be part of the consortium to get a contract through OTA.

Currently, about 28% of all contract dollars issued through NUWC go to small businesses, which Woodhouse defined as those with 500 to 1,000 employees or fewer.

Contracts approved through the OTA process are not subject to all the federal laws and regulations that apply to conventional government procurement.

That’s intended to improve NUWC’s access to innovative technologies from companies that otherwise wouldn’t be interested in dealing with the complexities of standard federal procurement procedures.

“It takes several years to develop, qualify and field state-of-the-art weapon-system technologies and even more for new undersea systems,” Navy Capt. Michael Coughlin, NUWC’s commanding officer, said when the special designation was announced last year. “Often, by the time a technology is ready for fielding, the original equipment or threat has changed,” he said about the need for the special contracting status.

Despite significant local benefits, contracting at NUWC hasn’t gone without an occasional hiccup. The last significant one to come to light was in 2011, when the Navy suspended all contracting authority there in the wake of a multimillion-dollar kickback scheme involving technology-services contracts.

The temporary shutdown led one contractor, Advanced Solutions for Tomorrow, to close its offices in Middletown and Georgia and more than 100 people lost their jobs.

Ralph M. Mariano, a Navy civilian engineer at NUWC who lived in Warwick, was sentenced to 10 years in federal prison in 2013 after being convicted of hatching the scheme that stole nearly $18 million in Navy contract money through shell companies. He and others convicted in the case also were ordered to pay back the money.

Last year, Pacific Architects and Engineers Applied Technologies was NUWC’s busiest vendor. The Virginia-based company received contracts with a combined value of more than $58 million in fiscal 2018, according to a list compiled by NUWC.

The company has no employees at the center or even in Rhode Island. Its work for NUWC is centered in the Bahamas at an underwater testing range for “submarine and antisubmarine warfare” at a site near Andros Island, where the company has 250 employees. PAE also has a related office in West Palm Beach, Fla., where it has 200 employees, said Jim Sands, PAE’s vice president of infrastructure and logistics.

“Newport is the ultimate authority for our work in the Bahamas and West Palm Beach,” Sands said.

STAYING LOCAL

Other companies keep the work local.

Systems Engineering Associates Corp., or SEA Corp., based in Middletown, was NUWC’s second-largest vendor in fiscal 2018, when it received contracts with a combined value of $48.5 million. Its business and staff are devoted entirely to providing services to the Navy.

SEA Corp. has more than 400 employees, spread out in three offices in Middletown and two offices in Groton, Conn., near the Navy’s main East Coast submarine base.

The company also has employees working on-site at NUWC and at two other locations in Virginia, according to the company’s website.

The company is headed by CEO Brian Gilligan, who co-founded the company in 1981 and became its sole shareholder in 1996. Before that, he was an electronic engineer at NUWC, which at the time was named the Naval Underwater Systems Center.

“NUWC is about 80% of our revenue,” SEA Corp. President Dave Lussier said, adding the company is pursuing new contract opportunities through the center’s OTA program.

To make more room for production, the company recently completed construction of a 4,000-square-foot second-floor mezzanine at the SEA Corp. Research Center, one of its three buildings in Middletown, Lussier said.

The next local, privately owned company on NUWC’s list of its largest vendors in 2018 is Middletown-based McLaughlin Research Corp., which had contracts totaling more than $30.8 million in fiscal 2018, ranking No. 7 overall on the list.

McLaughlin provides various engineering, technical and support services for NUWC, including for its torpedo and missile programs, said Domenic Gargano, the company’s chief operating officer.

Gargano said McLaughlin employs more than 300 people on Aquidneck Island, including about 250 on-site at NUWC and about 50 at the company’s Middletown headquarters.

McLaughlin’s revenue stream from NUWC has been steady in recent years, although it’s expected to increase somewhat this year, he said.

Ranking No. 9 on the list of NUWC’s most active vendors is Middletown-based Mikel Inc., which received contracts worth $19.7 million in fiscal 2018.

The company moved from Fall River to Aquidneck Island after shifting its focus to engineering services and started doing business with NUWC about seven years ago, said Kelly Mendell, the company’s president.

Today, NUWC contracts account for more than half of Mikel’s annual revenue, though Mendell would not be more specific.

Mikel has about 200 employees, including about 100 who work on-site at NUWC, between 50 and 60 at the company’s Middletown headquarters and the rest stationed in Washington, D.C., she said.

Before it established a business relationship with NUWC, Mikel was much smaller.

“It’s been extremely important from a revenue perspective and a jobs perspective,” Mendell said. “The role [NUWC] plays in the Navy is so important, so we perform at our very best. They’re so well-positioned in the technical community and they’re so influential.”

The OTA contracting program is creating new opportunities for companies such as PURVIS Systems in Middletown, said Debbie A. Proffitt, vice president of Department of Defense operations for PURVIS.

Ordinarily, PURVIS provides technical services for NUWC, working on sonar and acoustic equipment, developing software, designing hardware and other tasks – generally for submarines.

The company has about 125 employees, including 85 in Middletown. PURVIS gets about half its business from defense-related contracts. The company has been contracting with NUWC for most of its 47 years in business, Proffitt said.

To take advantage of OTA’s focus on research and development and technical innovation, PURVIS has partnered with Pawtucket-based Nautilus Defense and the University of Massachusetts Dartmouth to recently put in a bid for an OTA contract. The contract calls for research and development work that PURVIS wouldn’t have had the resources to do alone, Proffitt said.

She said the special contracting status cuts in half the time for a contract to be awarded. That brings in revenue sooner and makes the company’s hiring and financial planning easier. A standard contract may take a year or more to be awarded, she added, whereas the OTA process may only take six months.

“One advantage is that the contracting cycle is much shorter,” Proffitt said. “The other advantage … is the opportunity to leverage into other technology areas that we’re not currently working on or with, such as wet sensors for military aircraft. So, [OTA allows for] diversification of our capabilities.”

Scott Blake is a PBN staff writer. Contact him at Blake@PBN.com.